As the pressure increases on boards to demonstrating they are taking the sustainability challenges facing their organisations seriously, minds are turning to how ESG-matters (Environmental, Social, Governance) should be overseen and governance over ESG itself administered. This is particularly relevant considering the increasing focus of stakeholders on the alignment of ESG strategies with organisations’ purpose and mission. It is true to say that stakeholders are increasingly concerned regarding ‘greenwashing’ claims and are looking for authenticity in this alignment.

Like with most aspects of setting an ESG strategy, context is everything. What kind of organisation are we dealing with, what sector does is operating within and who are its stakeholders? This will determine in large part how best to oversee and govern ESG-matters. An important aspect of the role of a board ESG sponsor is to engage with fellow board directors and convince them of the need to clarify and strengthen ESG governance in the light of growing stakeholder interest and attention.

Central to a number of global standards such as the Taskforce for Climate-related Financial Disclosures (TCFD) is an expectation that governance arrangements over ESG matters will be established, maintained and disclosed.

As an example of how this might be approached, within Argo Group we firstly agreed that the most appropriate place for ESG as a whole to be overseen was within the Nominating & Corporate Governance Committee (N&CGC) of the board.

An important decision point was whether to establish a new, stand-alone Sustainability Committee at board-level or to work through the existing committee structures. Like many aspects of ESG governance there is no right or wrong answer, although certain stakeholders may see a dedicated committee as showing greater sponsorship and commitment. A counter argument is that utilising existing committee structures ensures that ESG is fully integrated and embedded into organizational strategy and processes, rather than possibly being dealt with as a ‘fringe’ issue.

In our case, the N&CGC committee, with support from the board ESG sponsor and the executive ESG lead, determined that each element of ESG was best addressed by the most appropriate existing board committee; whereas ESG strategy itself and program progress should be reported to the N&CGC.

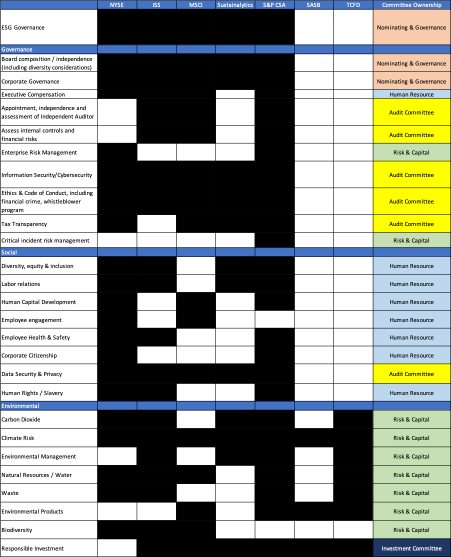

One of the current complexities of addressing ESG governance is that there is no single universally accepted definition of ESG and so we looked to various stakeholder groups, be these stock exchanges, regulators, ESG standards or ESG rating agencies to provide a multi-stakeholder mapping. The grid shown in Figure 1 was reviewed and aligned to the current board committee structure, which element of ESG assigned to be specific committee.

Some elements may be straight-forward to assign, for example with Responsible Investments going to the Investment Committee, and Diversity & Inclusion to the Human Resources Committee. Others may be more specific to the nature of the organisation, its committee structures and the way it chooses to manage certain ESG-factors, such as assigning Climate Risk to the Risk & Capital Committee, or Data Privacy to the Audit Committee. There is probably no single right answer in this respect, but it is a matter of what works most effectively for the organisation in question.

Figure 1 - ESG governance mapping

The N&CGC sponsored the adoption of the ESG governance framework, charging the chair of each board committee with ensuring their committee charters and agendas were updated to match this overall blueprint. The changes were made to the individual committees, with the amended agendas requiring new or modified papers to be prepared periodically. Each committee needed in turn to determine the nature of reports it wished to received, as well as their frequency and depth. This inevitably took several cycles to establish itself and bed-in. The ESG sponsor provided a focal point for coordination of progress, reporting back periodically to the N&CGC on overall progress made and lessons learned.

One of the main lessons so far is that many aspects of ESG are not new to the organisation, they simply had not been seen through an external stakeholder lens previously. Looking at each challenge in the context of the organisation’s purpose is helpful ensuring it is appropriately addressed. Moving from an internal to an external frame of reference means for example that Data Privacy becomes an issue of trust in how the organisation protects its client’s information and only a regulatory issue; Diversity & Inclusion now considered the attraction of future talent and not only the treatment of current employees.

In other words, establishing clear governance and oversight over ESG matters is not purely a matter of good governance and corporate hygiene, it is an enabler of better decision making through ensuring ESG is integrated into existing decision-making frameworks and dealt with in isolation. It also facilitates clearer and more authentic communication of ESG objectives and outcomes to key stakeholder groups.

Alex Hindson is Chief Risk & Sustainability Officer at Argo Group and co-chair of the Risk Officer Sustainability Forum